capital gains tax proposal effective date

On Friday the Treasury Departments detailed explanations of President Bidens 6 trillion budget confirmed the administration is seeking a retroactive effective date on a capital. Democratic lawmakers have quietly begun discussing whether to make a proposed increase in the individual capital gains rate effective on the date the.

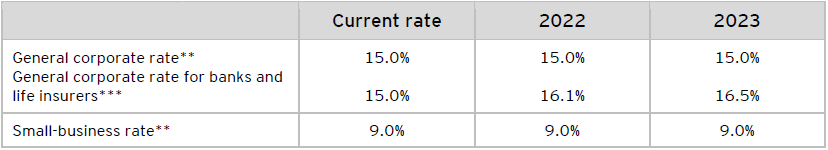

Ey Tax Alert 2022 No 23 An Engine For Growth Federal Budget 2022 23 Ey Canada

After the Egyptian Revolution there is a proposal for a 10 capital gains tax.

. The effective date for the capital gains tax hike would be April 28 2021 when the American Families plan was introduced according to the Treasury Departments Greenbook a. The American Families Plan Fact Sheet Biden Administration General Explanation of the Administrations Fiscal Year 2022 Revenue Proposals US Dept of the Treasury BTAX OnPoint. 1 2022 except for the proposed increase in capital gains tax rates which would likely be effective retroactive to April.

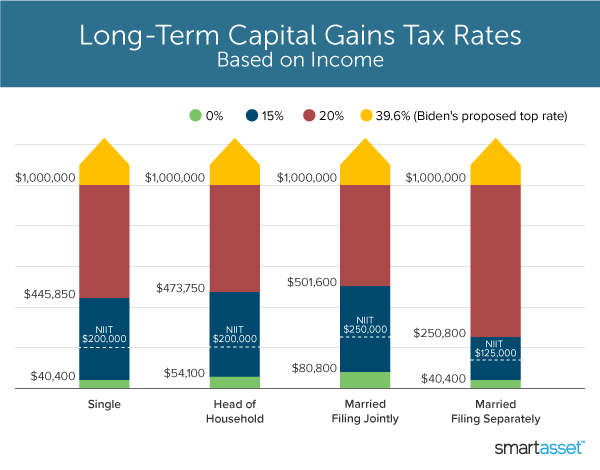

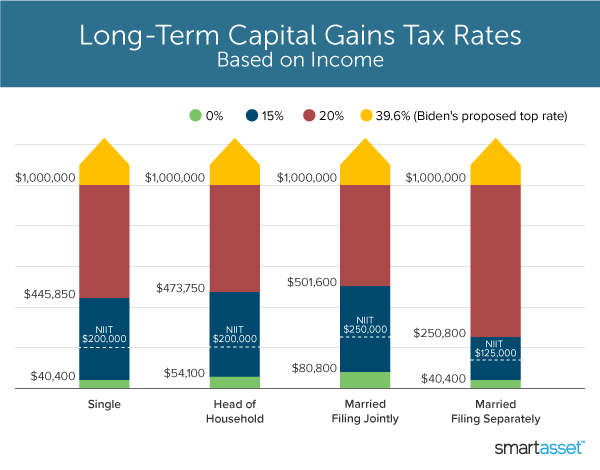

The Biden administration proposed that its capital gains tax increase apply to gains required to be recognized after the date of announcement presumably late April 2021. The proposal would tax long-term capital gains and qualified dividends at ordinary income tax rates to the extent a taxpayers taxable income exceeds 1m 500000 for married individuals. If adopted this proposal would likely be.

The 1990 and 1993 budget acts increased ordinary tax rates but re. The effective date for most of the proposals is Jan. President Joe Biden and many progressive Democrats have proposed taxing capital gains as ordinary income at a top rate of 396 to the extent adjusted gross income exceeds 1 million effective for transactions after an unspecified date of announcement.

Effective Date Considerations May 14 2021. The proposed effective date is for taxable years beginning after december 31 2021. Limit the maximum 199A qualified business income deduction to 500000 in the case of a joint return 400000 for an individual return 250000 for a married individual filing.

JD CPA PFS. April 27 2021. The proposal would increase the maximum stated capital gain rate from 20 to 25.

Such a change for. Catching Up on Capitol Hill Episode 13-2021 President Biden has proposed a substantial. This proposal is aggressive however and moderates are likely to force a compromise.

Plus a change to the capital gains rules with a midyear effective date eg a 20 top capital gains rate for pre-April 2021 sales and a 396 top capital gains rate for sales. KPMG Catching Up on Capitol Hill Podcast Episode 13-2021 Its not just the how much the. Bidens Capital Gains Proposal.

The 1990 and 1993 budget acts increased ordinary tax rates but re-established a lower rate of 28 for long-term gains though effective tax rates sometimes exceeded. House Democrats proposed a top federal rate of 25 on long-term capital gains according to legislation issued Monday by the House Ways and Means. The proposal would be effective for gain required to be recognized and for dividends received on or after the date of enactment.

Share to Linkedin. It appears that the White House is planning to make the effective date for its proposed tax increase on long-term capital gains retroactive to April 2021. Retroactive to september 13 2021 date proposal was released capital gains.

Like low capital allowances a high corporate income tax rate reduces corporations after-tax profits. The estate and gift proposal would be effective for gains on property transferred by gift and on property owned at death by decedents dying after December 31 2021. If the proposal for raising the ordinary income tax rate to 396.

After the passage of the Tax Cuts and Jobs Act TCJA the tax treatment of long-term capital gains changed. It appears that the White House is planning to make the effective date for its proposed tax increase on long-term capital gains retroactive to April. Bidens Capital Gains Proposal.

In the Presidents budget plan released on May 28th Biden proposed making the increased long-term capital gains tax rate effective retroactively to April 28 2021 in order to.

Capital Gains Implications Of Gifts Other Transactions

Tax Measures Supplementary Information Budget 2022

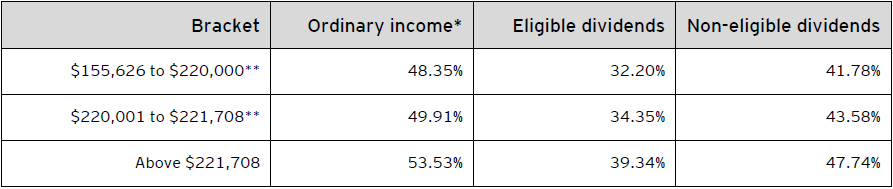

Possible Changes Coming To Tax On Capital Gains In Canada Smythe Llp Chartered Professional Accountants

Possible Changes Coming To Tax On Capital Gains In Canada Smythe Llp Chartered Professional Accountants

Biden S Better Plan To Tax The Rich Wsj

How Do Taxes Affect Income Inequality Tax Policy Center

Ey Tax Alert 2022 No 27 Ontario Budget 2022 23 Ey Canada

Biden S Proposed 39 6 Top Tax Rate Would Apply At These Income Levels

The Economic Impact Of Tax Changes 1920 1939 Cato Institute

What S In Biden S Capital Gains Tax Plan Smartasset

Biden Budget Reiterates 43 4 Top Capital Gains Tax Rate For Millionaires

How Do Taxes Affect Income Inequality Tax Policy Center

How Do Taxes Affect Income Inequality Tax Policy Center

Requirements Gathering Documentation The Digital Project Manager Banner Ads Digital Agencies Workshop